defer capital gains tax australia

Well the answer to this question Deval is that from my knowledge you cant actually save capital gains tax by reinvesting it in another property. An individual who elects under the taxation law of a Contracting State to defer taxation on income or gains relating to property which would otherwise be taxed in that State.

12 Ways To Beat Capital Gains Tax In The Age Of Trump

The Guide to capital gains tax 2022 explains how CGT works and will help you calculate your net capital gain or net capital loss for 202122 so you can meet your CGT obligations.

. It is not a separate. You report capital gains and capital losses in your income tax return and pay tax on your capital gains. Net capital gains are either taxable zero or equal to 0 for single and joint filed filings jointly as long as your.

The investor is then exempt from income tax for that proportion of the income distributions they have. Centrelink pensions 13 23 00. Now although you may have read Rich dad poor.

Gains on the sale of collectibles are taxed at 28. If you are an individual you may prefer to use. Capital gains tax CGT is the tax you pay on profits from selling assets such as property.

Skip to primary navigation. On this page. Tax rates on capital gains typically range from 15 to 20 percent.

You report capital gains and capital losses in your income tax return and pay tax on your capital gains. The gain is deferred until December 31 2026or to the year when the. I set up a Self-Managed Super Fund SMSF to deposit the 250000 proceeds.

You recently mentioned deferring a capital gains tax CGT liability. Timing capital gain or loss. Although it is referred to as capital gains tax it is part of your income tax.

Income Tax Calculator. A Australia does not have any system where you can defer CGT by rolling the profit into another investment. Even though it forms part of your income tax and is not.

Australian Financial Complaints Authority 1800 931 678. Here are some of the main strategies used to avoid paying CGT. Current tax rates for long-term capital gains can be as low as 0 and top out at 20 depending on your income.

This option allows me to defer paying the capital gains tax not avoid paying it. Instead the capital gain you make is added to your assessable income in whatever year you sold the property. This is the difference between what it cost you and what you get when you.

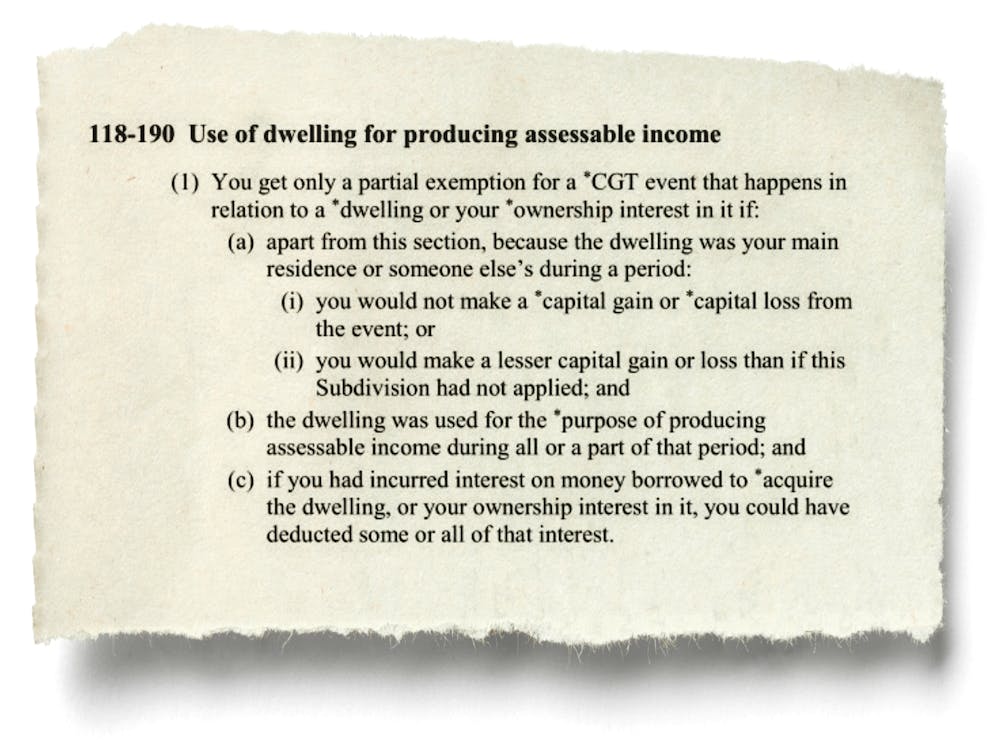

Here are five ways you. Sometimes you can choose to roll over a capital. Capital gains tax CGT in the context of the Australian taxation system is a tax applied to the capital gain made on the disposal of any asset with a number of specific exemptions the most.

Australian Financial Complaints Authority 1800 931 678. Long-term capital gains are. Once upon a time you could have deferred capital gains taxes from the sale of that stock through use of a 1031 exchange.

By learning the tax exemptions and discounts youre eligible for you could lower your capital gains tax from investment property youve decided to sell. For a gain to be deferrable it must be invested in a QOF within 180 days of the sale that resulted in the gain. Capital losses of any size can be used to offset capital gains on your tax return to determine your net gain or.

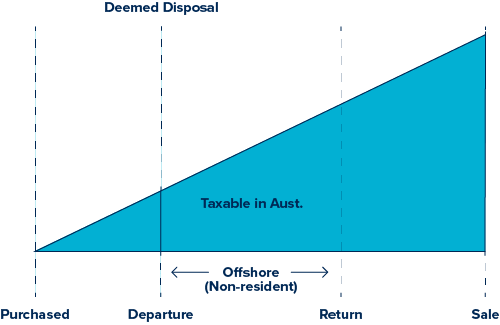

Leaving Australia means capital gains tax can arise - CGT Event I1 - as there is a deemed disposal of investments at their market value. Fortunately the system does give you a 50 per cent discount on the. However the Tax Cut and Jobs Act TCJA which.

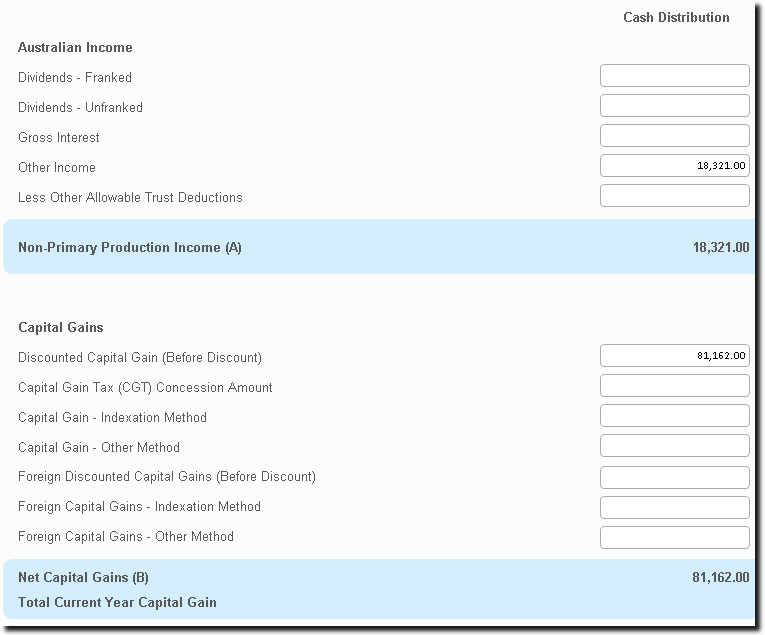

If your business sells an asset such as property you usually make a capital gain or loss. A Tax-deferred rate will be determined for each financial year eg. There are links to worksheets in this guide to help you do this.

For example a business can apply for an extension if it needs to replace a rollover asset and has not acquired the asset in the time allowed. The Federal Government has made changes to Australian Capital Gains Tax for non residents that impacts Australian expats who still own a property back home.

Pdf Taxing Capital Gains A Comparative Analysis And Lessons For New Zealand

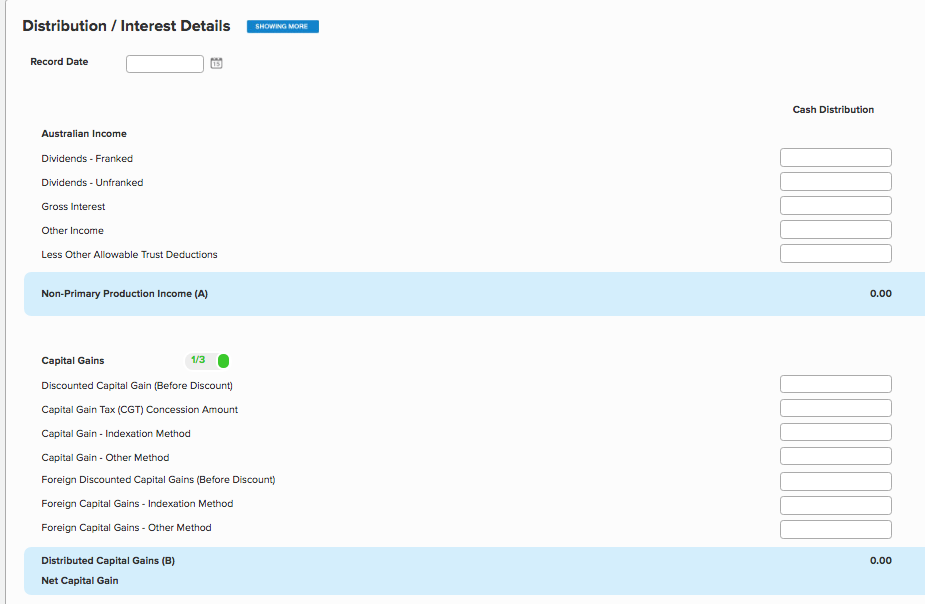

Tax Deferred Received From Distribution Exceeds Cost Base Of Investment Simple Fund 360 Knowledge Centre

Can You Defer Capital Gains Tax In Australia Ictsd Org

How To Sell Gold Without Paying Taxes Is It Possible Gold Galore

What Is Capital Gains Tax Cgt Everything About Cgt

How To Enter A Distribution Tax Statement Simple Fund 360 Knowledge Centre

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Make Tax Free Capital Gains On Australian Shares Whilst A Non Resident Expat Expat Taxes Australia

Capital Gains Tax How It Affects Commercial Property Commercial Loans

Can You Defer Capital Gains Tax In Australia Ictsd Org

What Are The Capital Gains Tax Rules In Australia Ictsd Org

What Is A Deemed Disposal Atlas Wealth Management

How To Avoid Capital Gains Tax On Property In Australia Ictsd Org

What Is Capital Gains Tax In Western Australia Ictsd Org

How To Legally Avoid Crypto Taxes Koinly

How To Calculate Capital Gains Tax On Property Australia Ictsd Org

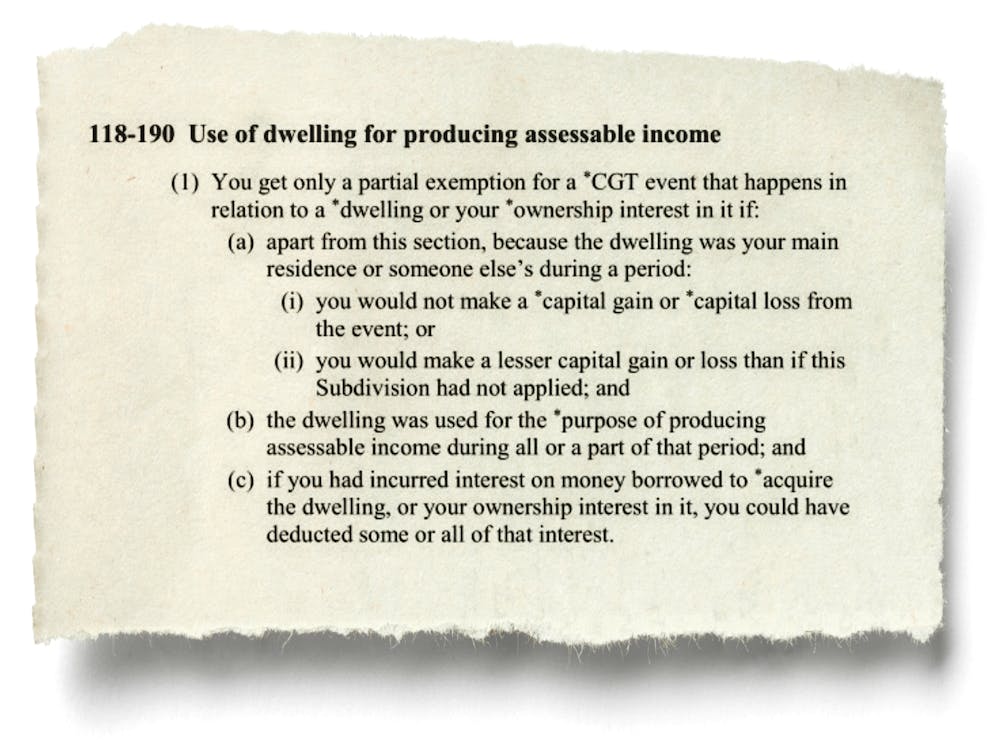

Be Careful What You Claim For When Working From Home There Are Capital Gains Tax Risks Unsw Newsroom

12 Ways To Beat Capital Gains Tax In The Age Of Trump

How To Avoid Capital Gains Tax On Investment Property Australia Ictsd Org